All Categories

Featured

Table of Contents

- – Understanding Fixed Vs Variable Annuity Key In...

- – Breaking Down Your Investment Choices A Closer...

- – Understanding Choosing Between Fixed Annuity ...

- – Analyzing Pros And Cons Of Fixed Annuity And ...

- – Exploring the Basics of Retirement Options K...

- – Highlighting Fixed Vs Variable Annuity A Clo...

- – Black Swan Insurance Group

- – Breaking Down Your Investment Choices Everyt...

Set annuities generally supply a fixed rate of interest price for a specified term, which can vary from a few years to a lifetime. This ensures that you know precisely how much earnings to expect, streamlining budgeting and economic preparation.

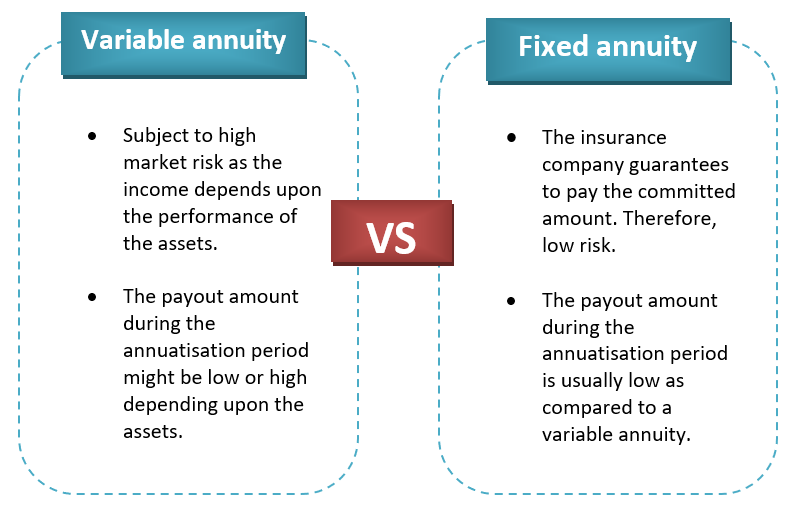

These benefits come at a price, as variable annuities have a tendency to have higher costs and expenses compared to dealt with annuities. Fixed and variable annuities serve various objectives and provide to differing economic concerns.

Understanding Fixed Vs Variable Annuity Key Insights on Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Annuities Fixed Vs Variable Can Impact Your Future Fixed Index Annuity Vs Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Vs Equity-linked Variable Annuity A Closer Look at Indexed Annuity Vs Fixed Annuity

Greater fees due to investment management and added attributes. For a comprehensive contrast, check out U.S. News' Annuity Introduction. Set annuities provide numerous benefits that make them a preferred option for traditional capitalists.

This attribute is particularly useful during durations of financial unpredictability when various other investments may be unpredictable. Furthermore, fixed annuities are simple to comprehend and handle. There are no complicated financial investment approaches or market risks to browse, making them an excellent option for people that like a straightforward financial item. The foreseeable nature of repaired annuities likewise makes them a reputable device for budgeting and covering necessary expenses in retirement.

Breaking Down Your Investment Choices A Closer Look at Variable Annuities Vs Fixed Annuities What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing Between Fixed Annuity And Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Variable Vs Fixed Annuities Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing What Is A Variable Annuity Vs A Fixed Annuity FAQs About Fixed Income Annuity Vs Variable Growth Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Annuity Vs Variable Annuity A Beginner’s Guide to Retirement Income Fixed Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

These features supply additional safety and security, making sure that you or your recipients obtain a predetermined payment despite market efficiency. Nonetheless, it is essential to keep in mind that these benefits typically come with extra costs. Variable annuities supply a special mix of development and safety, making them a functional option for retirement planning.

Retired people seeking a secure revenue resource to cover important costs, such as real estate or health care, will certainly benefit most from this kind of annuity. Set annuities are also appropriate for conventional financiers who intend to prevent market dangers and concentrate on protecting their principal. Furthermore, those nearing retired life may discover fixed annuities particularly important, as they offer assured payments during a time when monetary stability is critical.

Understanding Choosing Between Fixed Annuity And Variable Annuity Key Insights on Your Financial Future Defining Fixed Index Annuity Vs Variable Annuity Features of Fixed Income Annuity Vs Variable Growth Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Annuity Fixed Vs Variable: Simplified Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Tax Benefits Of Fixed Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding What Is Variable Annuity Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Variable annuities are better fit for people with a higher danger resistance that are looking to maximize their financial investment development. Younger retired people or those with longer time horizons can gain from the growth potential offered by market-linked sub-accounts. This makes variable annuities an eye-catching option for those that are still focused on building up riches throughout the onset of retirement.

An annuity is a lasting, tax-deferred investment developed for retirement. It will change in value. It enables you to develop a taken care of or variable stream of income through a process called annuitization. It offers a variable price of return based upon the performance of the underlying investments. An annuity isn't meant to change reserve or to fund short-term savings objective.

Your selections will certainly affect the return you gain on your annuity. Subaccounts normally have no guaranteed return, however you might have an option to place some cash in a fixed interest price account, with a rate that will not alter for a collection period. The value of your annuity can transform every day as the subaccounts' values transform.

Analyzing Pros And Cons Of Fixed Annuity And Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Fixed Vs Variable Annuities Matters for Retirement Planning Fixed Vs Variable Annuity Pros And Cons: A Complete Overview Key Differences Between Fixed Vs Variable Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuity A Beginner’s Guide to Choosing Between Fixed Annuity And Variable Annuity A Closer Look at Variable Annuity Vs Fixed Indexed Annuity

There's no assurance that the worths of the subaccounts will certainly boost. If the subaccounts' values go down, you might wind up with less cash in your annuity than you paid right into it. - The insurance provider uses an ensured minimum return, plus it offers a variable price based on the return of a specific index.

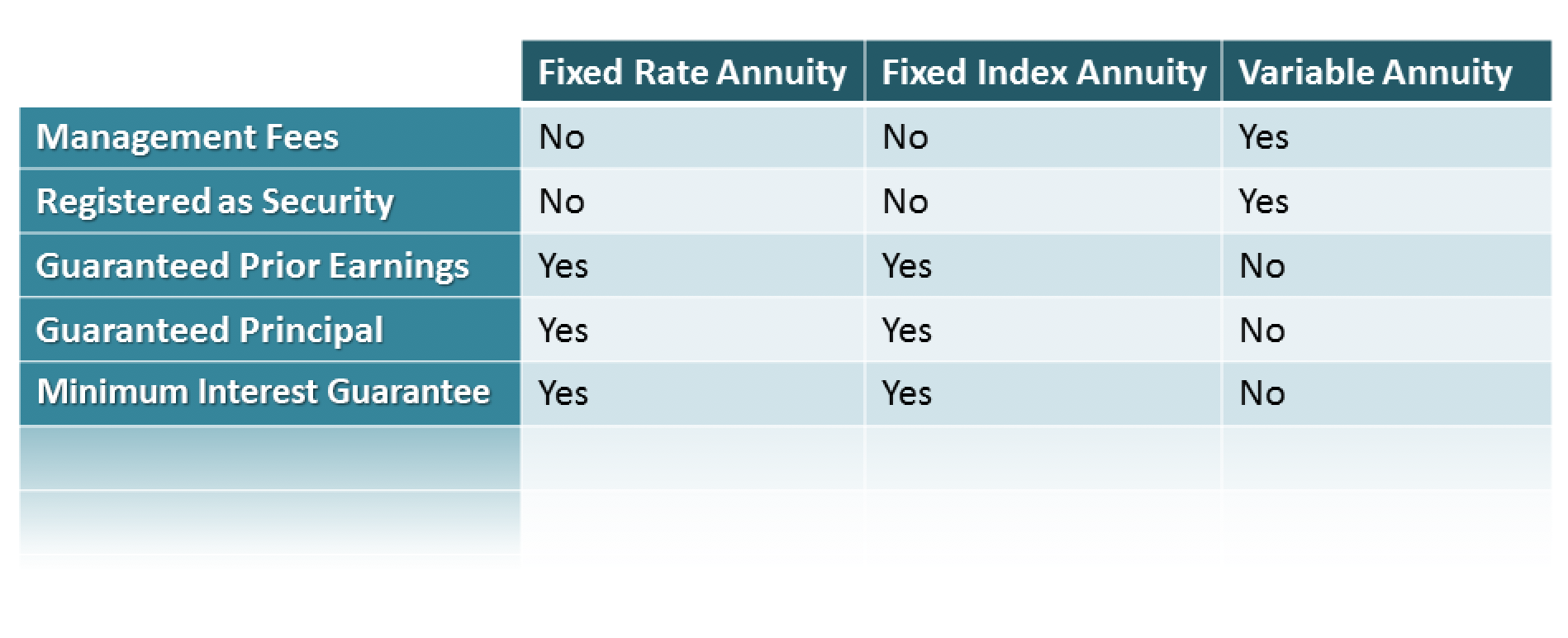

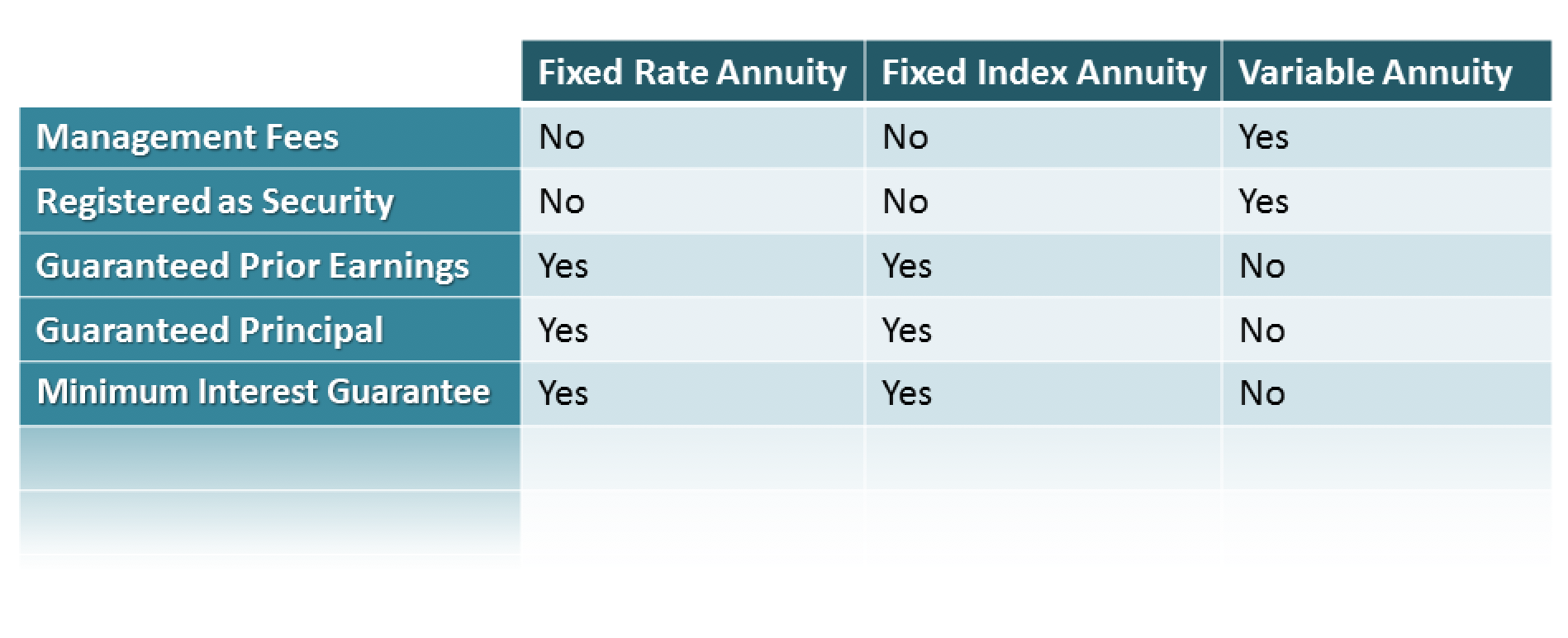

Shawn Plummer, CRPC Retirement Coordinator and Insurance Coverage Agent Feature/CharacteristicFixed Index AnnuitiesVariable AnnuitiesEarnings are based on a formula connected to a market index (e.g., the S&P 500). The account value can reduce based on the efficiency of the underlying financial investments.

It may use a guaranteed fatality benefit alternative, which might be greater than the present account value. Extra complex due to a range of financial investment alternatives and features.

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Defining Fixed Income Annuity Vs Variable Annuity Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Simplified Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Choosing Between Fixed Annuity And Variable Annuity A Beginner’s Guide to Variable Annuity Vs Fixed Indexed Annuity A Closer Look at How to Build a Retirement Plan

FIAs are developed to shield your major investment, making them an appealing alternative for conventional capitalists., your first financial investment is safeguarded, no matter of market performance.

This configuration allures to financiers who prefer a modest growth capacity without significant risk. VAs provide the potential for considerable growth with no cap on returns. Your revenues depend entirely on the performance of the selected sub-accounts. This can bring about substantial gains, yet it likewise means accepting the opportunity of losses, making VAs ideal for financiers with a higher threat resistance.

They are ideal for risk-averse investors looking for a risk-free investment option with modest growth capacity. VAs come with a higher danger as their value goes through market changes. They appropriate for capitalists with a higher risk resistance and a longer financial investment perspective that aim for higher returns despite possible volatility.

They may include a spread, participation rate, or various other charges. Recognizing these costs is crucial to guaranteeing they line up with your monetary approach. VAs usually bring higher charges, including mortality and cost threat charges and administrative and sub-account administration costs. These costs can considerably impact overall returns and must be carefully considered.

FIAs provide more foreseeable income, while the revenue from VAs might vary based on financial investment efficiency. This makes FIAs more effective for those seeking stability, whereas VAs are matched for those going to accept variable earnings for possibly higher returns. At The Annuity Professional, we recognize the challenges you deal with when picking the best annuity.

Highlighting Fixed Vs Variable Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Deferred Annuity Vs Variable Annuity Is a Smart Choice Pros And Cons Of Fixed Annuity And Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Annuities Variable Vs Fixed Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing Variable Vs Fixed Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

We think in locating the ideal service at the lowest prices, ensuring you attain your monetary goals without unneeded costs. Whether you're looking for the protection of major defense or the capacity for greater incomes, we use customized advice to assist you make the finest choice.

Based on the initial assessment, we will certainly develop a customized annuity strategy that fits your details needs. We will certainly explain the functions of FIAs and VAs, their advantages, and exactly how they fit right into your general retirement strategy.

Nonetheless, collaborating with The Annuity Specialist guarantees you have a secure, knowledgeable plan tailored to your needs, leading to a solvent and worry-free retired life. Experience the confidence and safety and security that comes with knowing your economic future remains in expert hands. Call us today for cost-free recommendations or a quote.

Fixed-indexed annuities ensure a minimum return with the potential for even more based on a market index. Variable annuities offer investment choices with higher danger and incentive capacity.

His goal is to streamline retired life preparation and insurance, guaranteeing that customers understand their options and safeguard the ideal protection at unbeatable prices. Shawn is the creator of The Annuity Expert, an independent online insurance agency servicing customers across the USA. Through this platform, he and his group aim to remove the guesswork in retirement preparation by assisting individuals locate the very best insurance policy protection at the most affordable prices.

Breaking Down Your Investment Choices Everything You Need to Know About Annuity Fixed Vs Variable What Is Retirement Income Fixed Vs Variable Annuity? Advantages and Disadvantages of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Annuity Vs Equity-linked Variable Annuity: How It Works Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Key Features of Variable Vs Fixed Annuities Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Annuities Variable Vs Fixed Financial Planning Simplified: Understanding Fixed Annuity Or Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

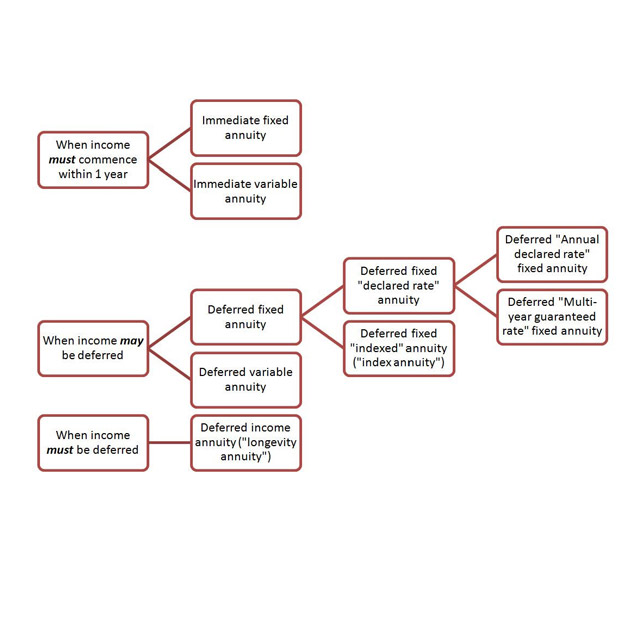

As you discover your retired life choices, you'll likely experience greater than a couple of financial investment strategies. Contrasting various kinds of annuities such as variable or fixed index belongs to the retired life planning procedure. Whether you're close to retired life age or years far from it, making smart decisions at the start is vital to gaining the most incentive when that time comes.

Any kind of earlier, and you'll be fined a 10% very early withdrawal charge on top of the earnings tax owed. A fixed annuity is basically a contract between you and an insurer or annuity provider. You pay the insurer, through an agent, a costs that expands tax obligation deferred gradually by a rate of interest figured out by the agreement.

The regards to the contract are all outlined at the start, and you can establish points like a death advantage, earnings cyclists, and various other numerous options. On the various other hand, a variable annuity payout will be determined by the efficiency of the financial investment alternatives chosen in the agreement.

Table of Contents

- – Understanding Fixed Vs Variable Annuity Key In...

- – Breaking Down Your Investment Choices A Closer...

- – Understanding Choosing Between Fixed Annuity ...

- – Analyzing Pros And Cons Of Fixed Annuity And ...

- – Exploring the Basics of Retirement Options K...

- – Highlighting Fixed Vs Variable Annuity A Clo...

- – Black Swan Insurance Group

- – Breaking Down Your Investment Choices Everyt...

Latest Posts

Annuity Trust Beneficiary

Voya Annuity Forms

Massmutual Annuity Forms

More

Latest Posts

Annuity Trust Beneficiary

Voya Annuity Forms

Massmutual Annuity Forms